Jump to section: Solution Problem Symptoms Reality-Check Document

20 years of out-of-touch leadership got us here. Their band-aids are no longer enough.We need to responsibly Pop the bubble and bail-out everyday Canadians.

The Solution

Broadly speaking, these are our three strategic shifts in how the real estate market should be handled by the federal government with the ultimate goal of resetting the market to 2019 levels:

1. Responsibly POP the bubble

This will be the beating heart of our policy, popping the bubble will bring down home and rent costs to reasonable levels. It won't be easy, but it is possible.

The outline of what we will do is:

Heavily restrict investors, both internal and external.

Make mortgages harder to issue (pending more research on impacts)

Bail-out Canadian first time buyers who entered the market when it was too high by slashing outstanding mortgages to match correction drop. Applies to variable and fixed-rate mortgages

Freeze rents until the price-correction stops

A side efffect of our pause & reform immigration strategy is a reduction of demand for 1 to 2 years.

2. Increase home supply

This will ensure that supply keeps up with demand:

Empower municipalities to not financially rely on high property values by limiting their control over property taxes and giving them limited control over sales taxes (around 1~2%). Will incentivize promoting economic activity over real estate investment.

Get cities to blanket rezone land use through a conditional funding scheme. This should increase private business construction

Have the government build desirable non-market homes directly at a steady rate

Address the lack of tradespeople through a new immigration stream. This is one of the 3 exemptions to our immigration pause.

3. Ensure it does not repeat

Guard rails would need to be added to ensure the tragedy never repeats. Currently being investigated.

The Problem

The current affordability crisis is undeniable to any observer or more importantly, any Canadian citizen. It is a result of the record increase in the price of basic necessities, rents, and homes.

There are many arguments offered to explain this rise in prices:

Higher interest rates by the Bank of Canada

Supply chain issues due to Covid

Supply chain diversification cause by changing geopolitics

A tight labour market (I.e. unemployment being too low)

Corporate Greed

While all of the above mentioned factors definitely play a role, we at the Future Party see that the root cause of the affordability crisis is the housing crisis. It is the biggest drain on renter/homeowner budgets, it is the main reason why minimum wages can't afford anything, and it is robbing productive industries from the investments they need to keep going.

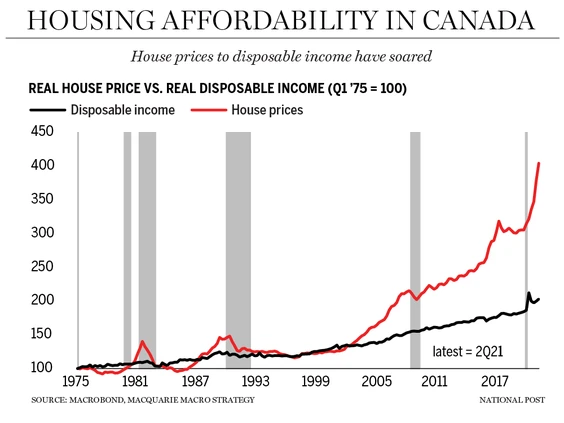

The housing crisis has been growing for 20 years, The two charts below show how much average incomes and house prices increased over decades. One is for Canada, the other for the USA. Charts are courtesy of this article. Neither the Conservative leadership from 2006 to 2015 nor the Liberal leadership since then did anything to actually solve the issue.

The Symptoms

Over the past 20 years, the real estate market has grown to a concerning level. Here's a sample of the trends:

It is Canada's biggest "industry" at 12%, construction is another 7%.

Residential mortgages make up 37% of the banking sector’s assets (that figure is 11% in the US). If you include commercial mortgages, this becomes 43%.

38% of MPs across ALL current political parties are real estate financiers or landlords

An increasing percentage of new real estate is purchased by investors

The simple root cause is that the people's need for shelter has become a financial investment.

The damage can be seen in these simple facts:

Households owe more than Canada’s entire GDP, mostly due to mortgages

The majority of Canadians, 54%, are living paycheck to paycheck, and carrying more debt

Mayors can no longer afford their own cities despite their hefty incomes.

Even well paid young professionals are priced out of the market

Property taxes make up around 40% or more of most municipalities’ budgets

Municipalities rarely approve new projects out of fear of reducing home values

Amortizations (mortgage length) are being extended to avoid defaults

Riskier mortgages, and even interest-only mortgages, are becoming more common

Reality-Check

Obstacles to keep in mind:

Because of how entrenched real estate investment is, we want to avoid damaging livelihoods. To do so we will carry out our economic strategy and development strategy at the same time.

Real Estate "investors" might try to leverage lower government levels to hold us back.

For a more detailed write-up, check the pdf below: